tax on unrealized gains uk

For example if you were ahead of the curve and bought bitcoin for 100. This means you dont have to report them on your annual tax return.

Deferred Tax Asset Journal Entry How To Recognize

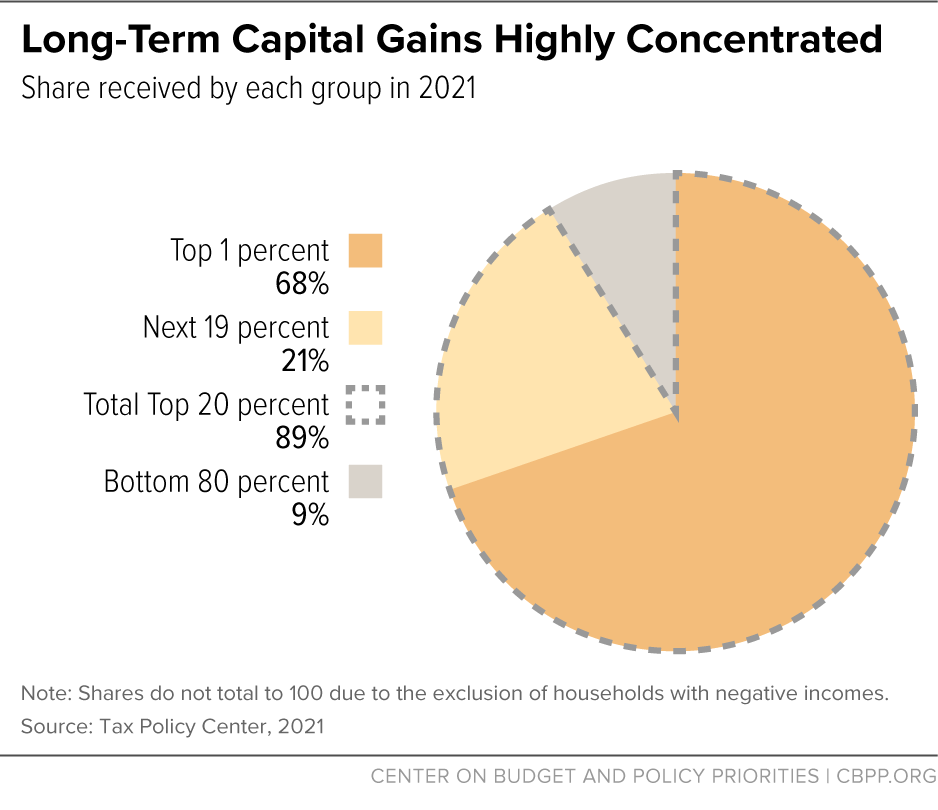

Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law capital gains exclusion of 250000500000 for primary.

. Total profits are the aggregate of i the. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more. There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into. Book a call today.

Try the UKs fastest and most trusted digital tax advice service. Capital gains tax is a tax on the profit that investors realise. Deduct your tax-free allowance from your total taxable gains.

But since you already paid 2 in taxes on those gains when they were unrealized. Capital gains are only taxed if they are realized which means. The way its currently structured the tax would affect the richest 700 Americans forcing them to include unrealized gains as part of their annual income.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. To increase their effective tax rate. How are capital gains taxed in UK.

Unrealized gains are not taxed by the IRS. The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains. Add this amount to your taxable income. Contact a Fidelity Advisor.

A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner. According to the ATAD Directive the tax levied on unrealized capital gains is intended to ensure that if a taxpayer moves assets or its tax residence out of the tax. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

Last reviewed - 27 July 2022. This tax called a billionaire minimum income tax would impose an annual 20 percent. Work out your total taxable gains.

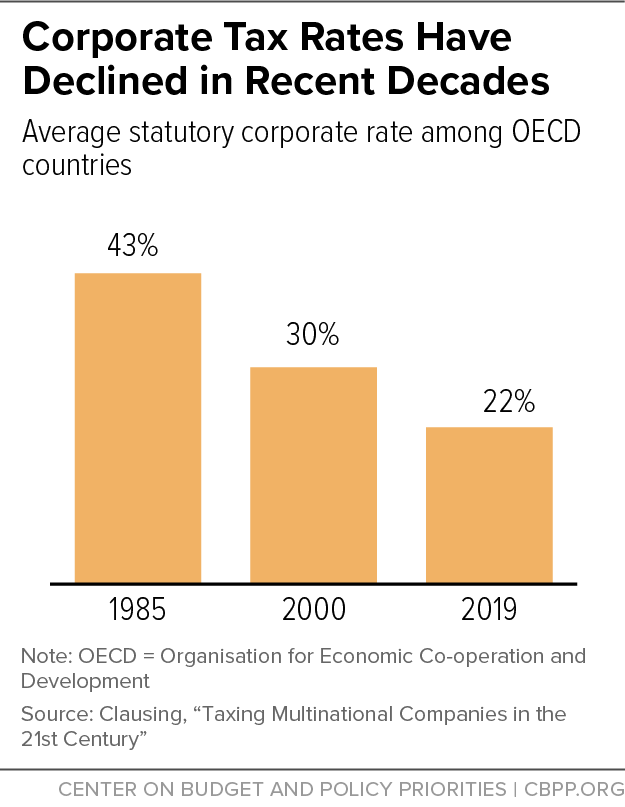

A UK resident company is taxed on its worldwide total profits. The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510. Corporate - Income determination.

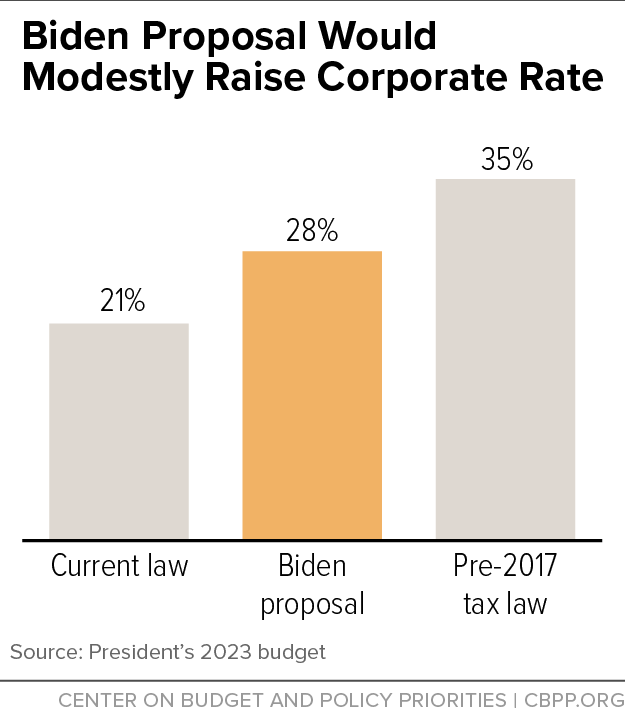

Rather there is a proposal floating around that would impose a 15 minimum tax on all corporations as the former Alternative Minimum Tax was repealed in 2017.

Derivatives And Hedging Accounting Vs Taxation

Crypto Tax Unrealized Gains Explained Koinly

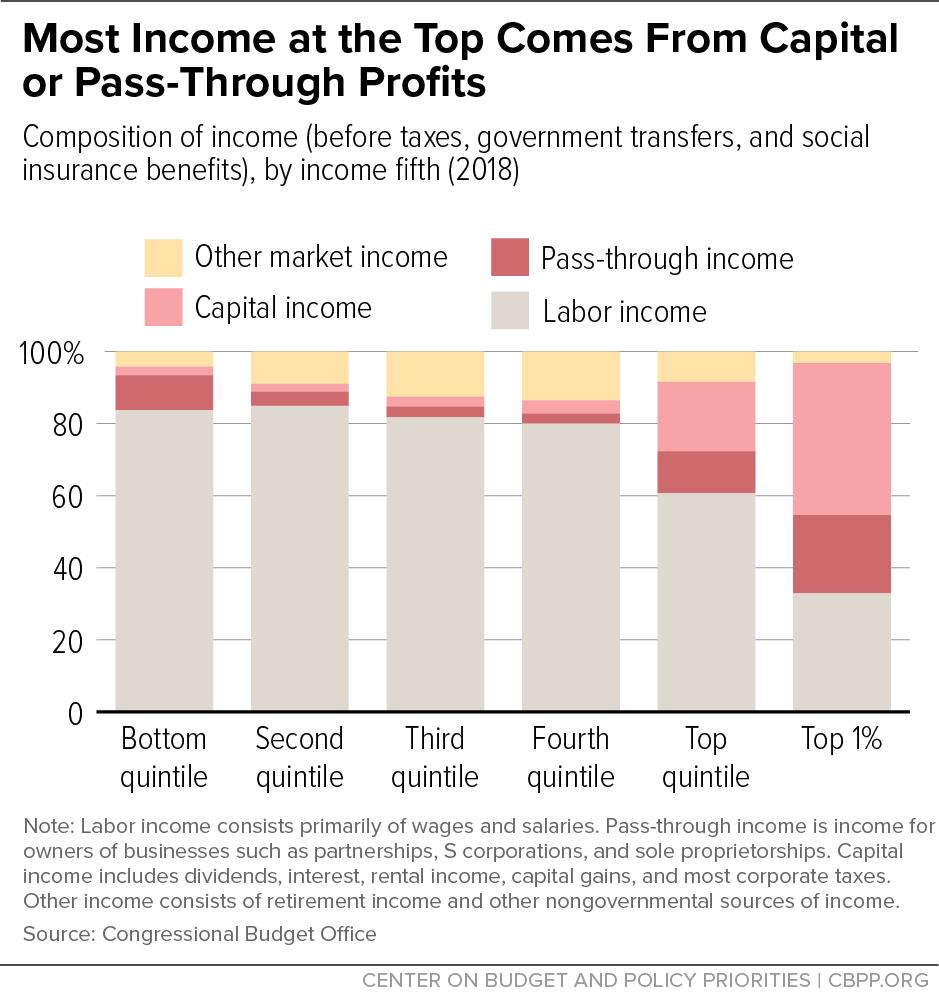

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Crypto Tax Unrealized Gains Explained Koinly

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

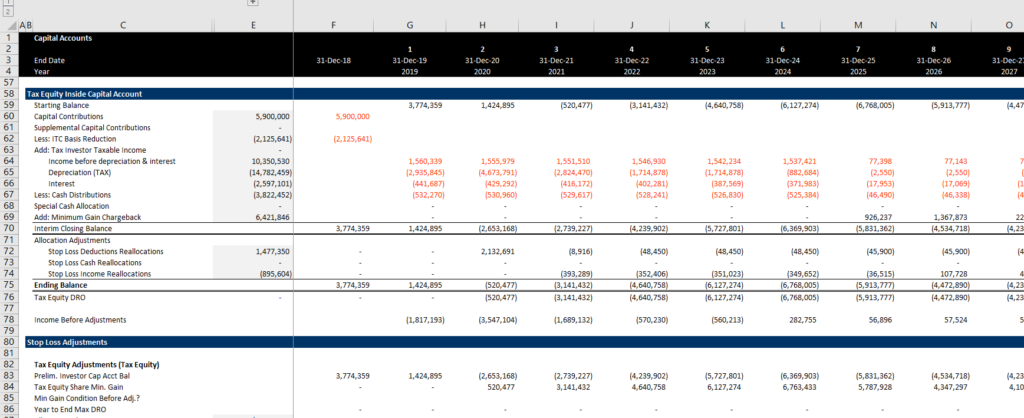

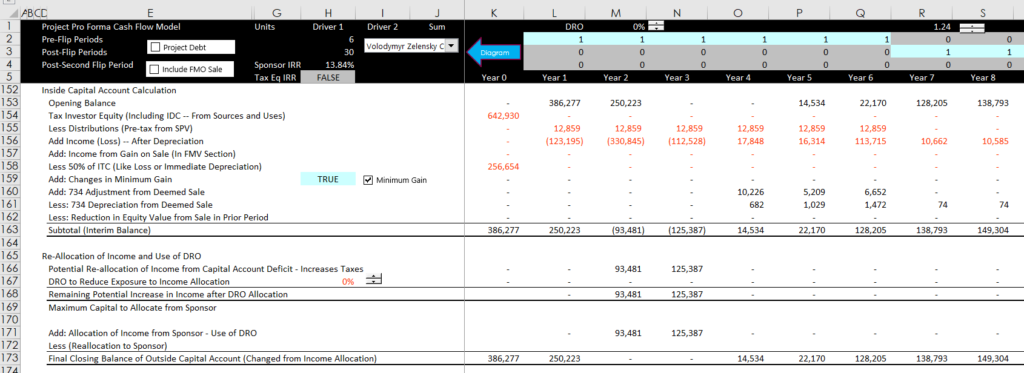

Inside Capital Account 704 B Edward Bodmer Project And Corporate Finance

Looking Back On Taxation Of Capital Gains Mark To Market Means To Pay On Unrealized Capital Gains Annually Stock Market Stock Market Quotes Capital Gain

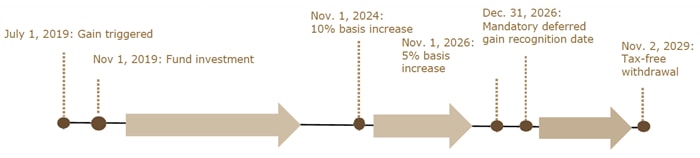

Qualified Opportunity Zones What Investors Should Know The Private Bank

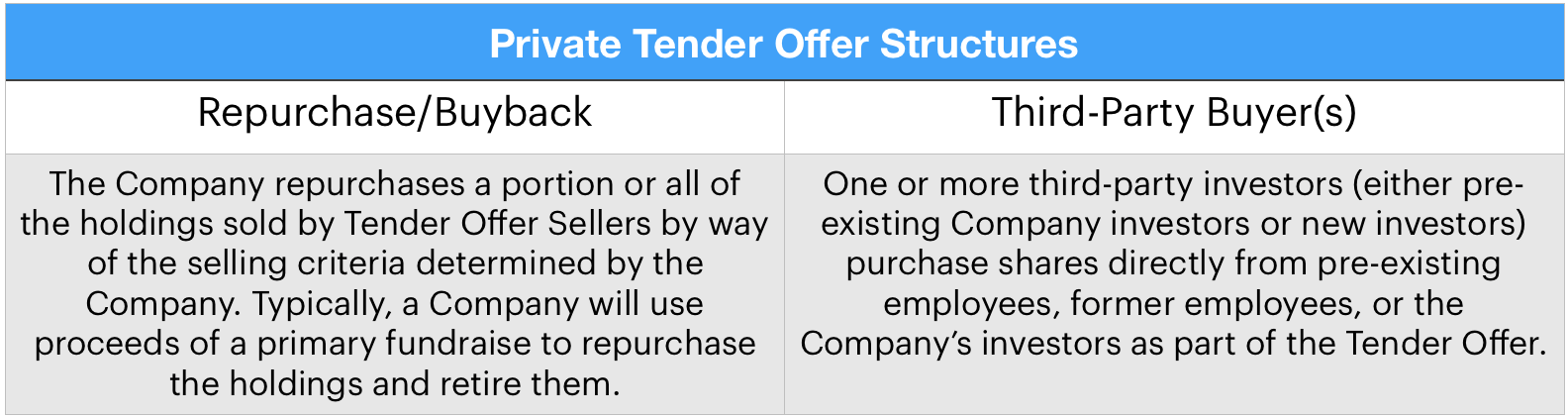

Understanding Tax Implications Of Tender Offers Carta

Inside Capital Account 704 B Edward Bodmer Project And Corporate Finance

Crypto Tax Unrealized Gains Explained Koinly

Capital Gains Github Topics Github

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

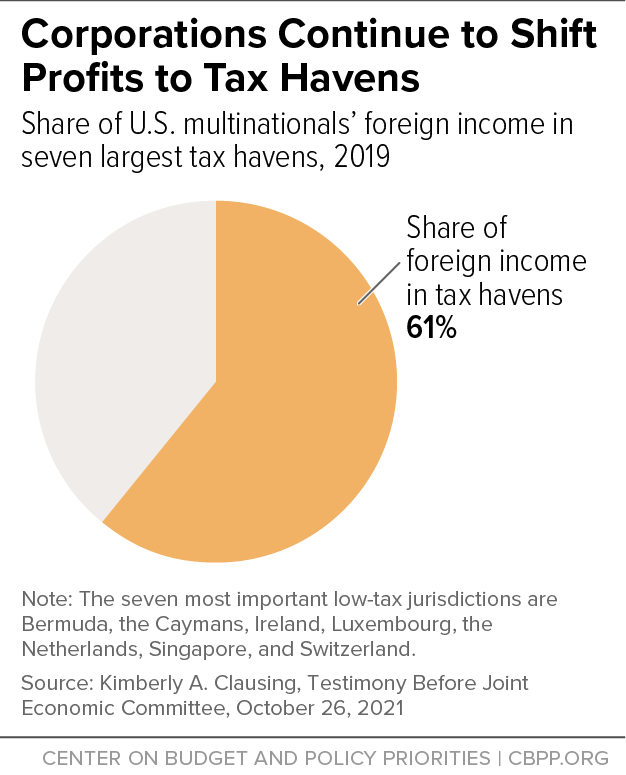

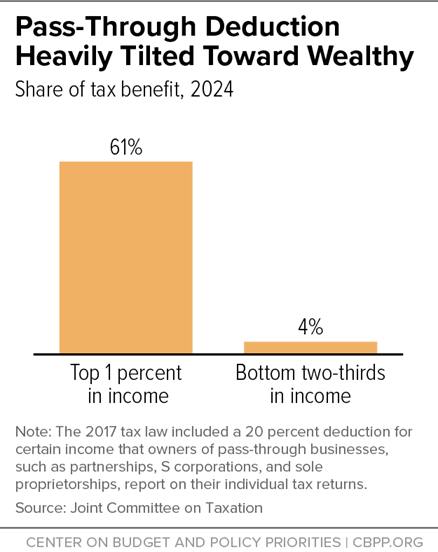

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities